In analyzing the current traits in stock development versus rising mortgage charges, it’s evident that the anticipated mannequin has hit a snag. Regardless of two weeks of serious development, the tempo slowed significantly final week, elevating questions concerning the impression of declining mortgage charges on this sample. Is that this slowdown merely a blip within the information, or does it signify a bigger shift out there dynamics? Let’s delve deeper into the weekly statistics to decipher the underlying components at play.

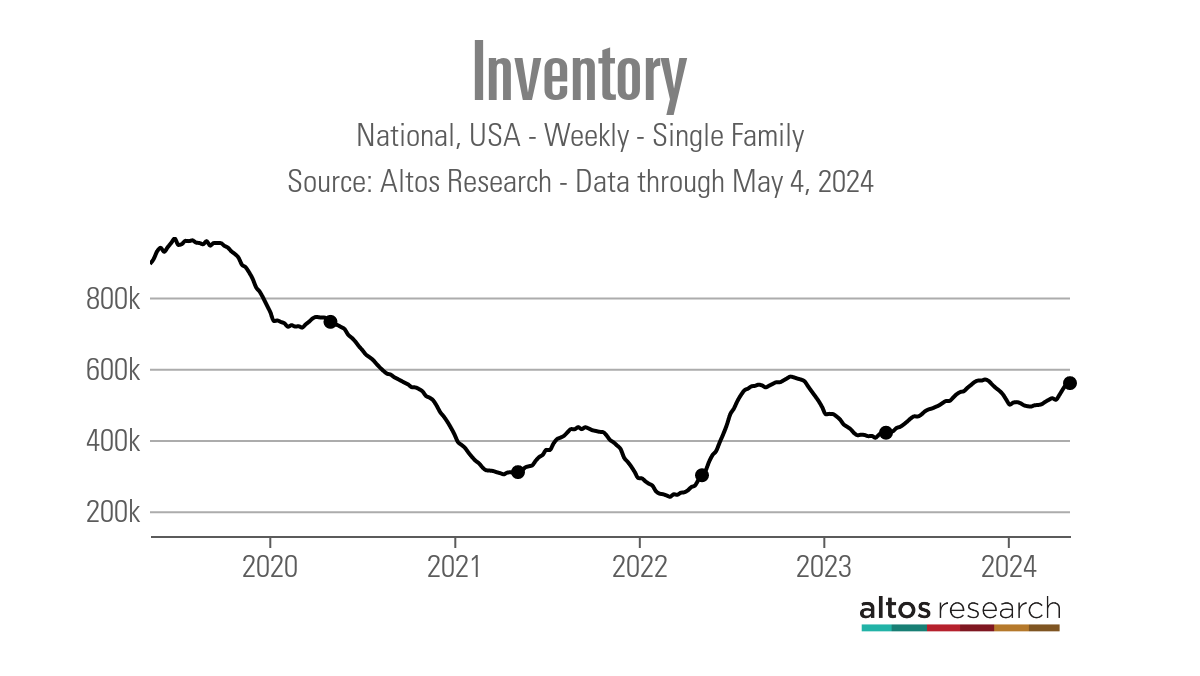

Weekly housing stock information reveals a blended image, with a modest enhance from 556,291 to 559,744 items recorded between April 26 and Might 3. This uptick contrasts with the decline noticed throughout the identical interval final 12 months when stock dropped from 421,924 to 420,489 items. It’s essential to notice that traits, quite than remoted weekly numbers, provide a extra correct reflection of market habits, particularly contemplating the upcoming Mom’s Day weekend.

The brand new listings information, however, paints a extra optimistic image, exhibiting regular development over time. Regardless of a slight weekly decline, the general trajectory stays optimistic, with new listings reaching 70,954 in 2024 in comparison with 57,682 in 2023 and 76,095 in 2022.

When it comes to value discount proportion, the info factors to a nuanced story. Whereas 2022 witnessed a sharper decline in value reductions, with a proportion of 20%, 2023 and 2024 are exhibiting a gradual enhance, with percentages of 29% and 33%, respectively. This pattern suggests a stabilization out there post-2022 turmoil, albeit with lingering results on pricing dynamics.

The interaction between the 10-year Treasury yield and mortgage charges provides one other layer of complexity to the market dynamics. Final week’s drop in yields and mortgage charges, influenced by components corresponding to job market traits and the Fed’s coverage stance, mirror the fragile steadiness at play. Regardless of ongoing challenges, together with sluggish buy utility information and job market uncertainties, the bond market’s response to those developments stays a key focal point shifting ahead.

As we navigate the intricacies of the actual property panorama, staying attuned to those nuances and adapting to evolving market circumstances can be essential for knowledgeable decision-making and strategic planning. By leveraging data-driven insights and sustaining a forward-looking perspective, trade gamers can navigate the trail forward with resilience and agility.